inherited annuity tax calculator

People inheriting an annuity owe income tax on the difference between the principal paid into the annuity and the value of the annuity at the annuitants death. First enter your current payroll information and deductions.

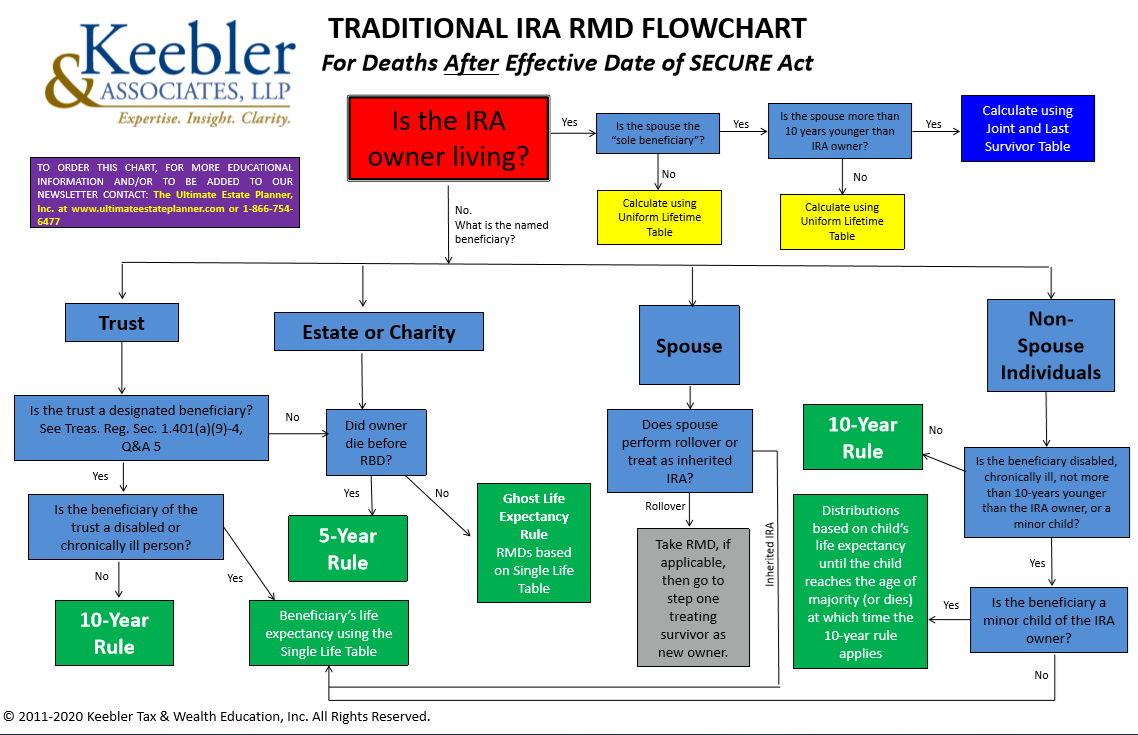

Successor Beneficiary Rmds After Inherited Ira Beneficiary Passes

First things first lets briefly define an inherited annuity.

. You may search for. Annuity Taxes for Surviving Spouses. Understanding how inherited annuities are taxed starts with knowing the difference between qualified and non-qualified annuities.

Section 529 plans are not guaranteed by any state or federal agency. From the IRS Tax Exempt Organization Search is an on-line search tool that allows users to verify that an organization is tax exempt and check certain information about its federal tax status and filings. Once you purchase the annuity your investment grows tax free for the length of the contract.

If they choose a lump sum beneficiaries must pay owed taxes. A qualified annuity is an annuity thats purchased using pre-tax dollars through a tax-advantaged account such as a 401k plan or an individual retirement account. Generally the best way for surviving spouses to minimize tax liability on an inherited annuity is to take the payments based on their life expectancy.

So the tax rate on an inherited annuity is your regular income tax rate. In most cases the annuity contract owner and annuitant dont have to be the same person or entity. With qualified annuities funds come from pre-tax dollars.

An inherited IRA is an individual retirement account opened when you inherit a tax-advantaged retirement plan including an IRA or a retirement-sponsored plan such as a 401k following the death. Its pretty much your run-of-the-mill annuity thats issued by an insurance or annuity company. The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on home loans up to 750000.

2 Certain taxpayers may be subject to backup withholding which requires a payer to withhold tax from payments not otherwise subject to withholding. Things To Consider Negative Tax Consequences. Use this calculator to help you determine your paycheck for hourly wages.

Tax liabilities differ depending on funds the owner used to buy the annuity in the first place qualified vs. 1 If your 70th birthday was July 1 2019 or later you do not have to take withdrawals until you reach age 72. Payouts are tax-free if the contract is a Roth IRA Annuity.

Annuity investments grow tax-deferred which means the retirement savings plan is not taxed until a withdrawal is made similar to an individual retirement account IRA 401k or Pension Plan. How taxes are paid on an inherited annuity will depend on the payout structure selected and the status of the beneficiary. Inherited Qualified Annuity Taxes.

The part of your annuity payout that is taxed depends on the type of annuity you have. Roth IRAs do not require withdrawals until after the death of the owner. You wont owe taxes until you receive income payments when the annuity matures.

For taxpayers who use married filing separate status the. The tax rate on an inherited annuity depends on the type of annuity and the beneficiarys relationship to the person who purchased the annuity. Organizations eligible to receive tax-deductible contributions Pub.

This is the cost of the home minus the down payment. If the annuity is an immediate annuity the entire payout is taxed as ordinary income in the year it is received. An annuity is a contract with an insurance company that promises to pay the buyer a steady stream of income in the future such as after retirement.

Start by entering the mortgage amount. For example an. However there are potential negative tax consequences if the Owner and Annuitant are not the same.

When transferring from one plan to another via a 1035 exchange the transfer must be like-to-like. What is an inherited annuity. Generally speaking an inherited annuity isnt a special type of annuity thats been hidden away from like a present that your parents didnt want to find.

Find the right online calculator to finesse your monthly budget compare borrowing costs and plan for your future. Division O section 111 of PL. 116-94 clarifies that employees described in section 414e3B which include ministers employees of a tax-exempt church-controlled organization including a nonqualified church-controlled organization and employees who are included in a church plan under certain circumstances after separation from the.

Withdrawals used for qualified expenses are federally tax. Modified AGI limit for certain married individuals increased. This means the owner paid no taxes not even on the principal.

A 1035 annuity exchange is a rule under Section 1035 of the Internal Revenue Code that allows for a tax-free exchange of a life insurance or annuity policy for a different annuity contract better suited to an owners needs. Taxes are due once money is withdrawn from the annuity. If you own a qualified annuity youll pay income taxes on the full withdrawal.

For example lets say youre considering purchasing a 250000 home and putting 20 percent down. 78 data Organizations whose federal tax exemption was automatically. By investing in a 529 plan outside of the state in which you pay taxes you may lose the tax benefits offered by that states plan.

Generally if you withdraw money from a 401k before the plans normal retirement age or from an IRA before turning 59 ½ youll pay an additional 10 percent in income tax as a penalty. How Inherited Annuities Are Taxed. If you are married and your spouse is covered by a retirement plan at work and you arent and you live with your spouse or file a joint return your deduction is phased out if your modified AGI is more than 204000 up from 198000 for 2021 but less than 214000 up from 208000 for 2021.

Learn more about backup. Then enter the hours you expect to work and how much you. HM Treasury is the governments economic and finance ministry maintaining control over public spending setting the direction of the UKs economic policy and working to achieve strong and.

The type of annuity you inherit affects your tax implications.

Financial Tools Calculators Pacific Life

Wealth Transfer Retireone For Rias

Inherited Annuity Tax Guide For Beneficiaries

2022 Traditional Ira Distribution Chart Ultimate Estate Planner

A Guide To Estate Taxes Mass Gov

How To Figure Tax On Inherited Annuity

How Are Inherited Annuities Taxed

Annuity Taxation Advisorworld Com

Making Annuity Inheritances More Tax Efficient

How Much Taxes Should I Plan On Paying For My Annuity Due

Understanding Annuities And Taxes Mistakes People Make

Death And Taxes Nebraska S Inheritance Tax

Financial Tools Calculators Pacific Life

In Ny Rmd Is Not Taxable From An Inherited Ira How Do I Do That On Turbo Tax On The 1099r Form Or Worksheet

Annuity Beneficiaries Inheriting An Annuity After Death

Is Your Inheritance Considered Taxable Income H R Block

:max_bytes(150000):strip_icc()/CalculatingPresentandFutureValueofAnnuities6-f3e0ae90db8b4a5398e3fcabd0538a92.png)

Calculating Present And Future Value Of Annuities

Nonqualified Tax Deferred Annuities White Paper Ultimate Estate Planner

Do I Pay Taxes On All Of An Inherited Annuity Or Just The Gain